“Smarts” are in the eye of the beholder. What’s a smart home “gotta have” for one is simply “cute but unnecessary” to another. Check out the top recommendations for older adult smart home safety features.

“Smarts” are in the eye of the beholder. What’s a smart home “gotta have” for one is simply “cute but unnecessary” to another. Check out the top recommendations for older adult smart home safety features.

Open enrollment presents you with an insurance crossroad once a year and, often, heavy pressure to join a Medicare Advantage plan. It’s best to look twice before you jump, however.

If you are like 68% of grandparents, you live too far away for regular interactions with your grandchildren. No reading bedtime stories or soothing little tears. No ticklefests or hands-on projects. These casual yet meaningful activities just aren’t an option.

A vast majority of older adults (77%) say they want to remain in their own homes as they age. Of course! Home is comfortable: We know where everything is—in the house, and also in the neighborhood and town. Friends, doctors, grocery store. We know how to get around quickly and easily. Plus, the emotional benefits of memories, identity, and history are baked into the walls of a home. But for many, the concept of staying put is based on how things are now and doesn’t factor in the changes that are bound to come.

Especially for older adults living alone, the ability to summon help in the event of an emergency—such as a fall—is a very real concern. With a cell phone in your purse or pocket, it’s easy to feel well set. Think again. The bathroom is where most falls occur. Do you take your cell phone in when you are using the toilet? Or taking a shower? And what if you hit your head and are unconscious? With a brain bleed, minutes count! But who wants to wear one of those telltale pendants? Fortunately, with the advent of smartwatches, there are stylish options that do not carry such stigma.

Three out of five (61%) of adults over 60 feel they have more stuff than they need. And yet many of us find it emotionally painful to cull our belongings.

While the physical labor of “right-sizing” is daunting, perhaps more powerful—and surprising—is the emotional challenge.

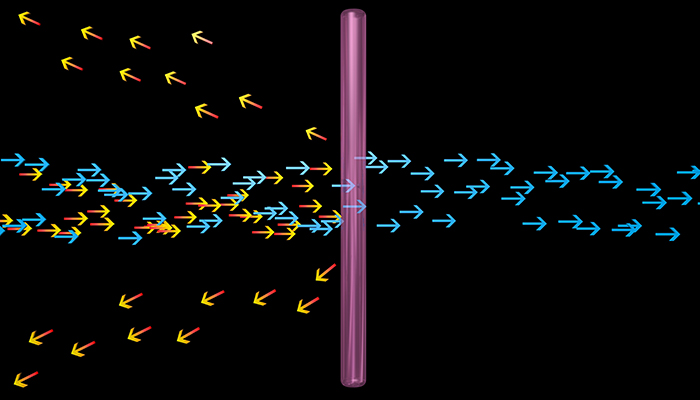

Do you find yourself more easily distracted these days? There is good reason: Concentration is about keeping what’s useful top of mind while at the same time suppressing thoughts that distract from your primary objective. As we age, the “executive” center of the brain becomes less able to sort out distractions. It’s a filtering process that requires heavy brainpower. Many people worry that lapses in concentration are an early sign of Alzheimer’s. Not necessarily. While memory and focus are related, they are not the same thing.

Are you tired of long waits to get an appointment? Rushed visits? Not being able to talk to your doctor by phone or communicate via email? You aren’t alone. Doctors dislike it too. But because most physicians today are employees of a large medical group, they are required to complete 30–40 patient visits per day. Appointments are set to last no more than 15 minutes. This is necessary to manage a typical patient load of 4,000.

If you have trouble participating in conversation in a noisy room or tend to want the TV volume turned up, you might want to investigate a new category of device called an enhanced “hearable.” Up until now, there have been few options short of a hearing aid for people with only mild hearing loss. The best have been “personal sound amplification devices” that fit in the ear like a hearing aid. While reasonably affordable and easily purchased online, they have the disadvantage of amplifying all sounds, even the ones you don’t want to hear.

Are you enjoying a love you never thought you’d feel again? It’s hard to be happy, though, if your children rain on your romance. Are they being selfish? Not necessarily. An in-depth study of “adult stepfamilies” revealed how disruptive it is when a parent gets involved with a new partner later in life.

© 2002-2025, Ferretto Young Care Management Consulting. Site created by Elder Pages Online, LLC.